KITE Mechanics

1. Overview

The KITE token has two main functions inside the HAI protocol:

Backstop mechanism: KITE stakers are the first line of defense in case the HAI protocol goes underwater. The second line of defense is with debt auctions that mint new KITE and auction it in exchange for HAI

Ungovernance: once governance minimization is finalized, KITE holders will be able to remove control from any remaining components in HAI or, if needed, continue to manage components that may be challenging to ungovern (such as oracles or any other component interacting with other protocols)

2. HAI Resource Flow

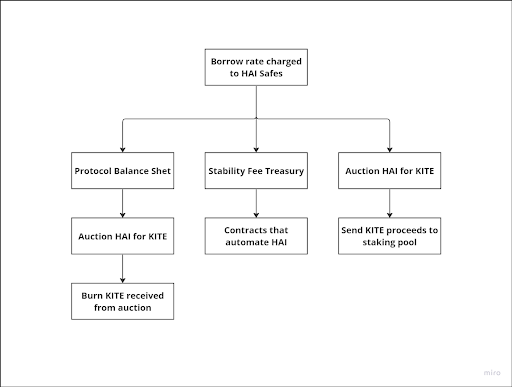

Before the protocol is governance minimized, HAI will be set up so that stability fees (borrow rate charged to Safes that mint HAI) flow in three places:

The stability fee treasury, which is a smart contract in charge of paying for oracle updates or any other contract meant to automate HAI parameters

KITE stakers, which are the first line of defense for the protocol

Buyback and burn, which is meant to auction HAI in exchange for KITE which is subsequently burned

In the case of KITE stakers, the HAI that accrues for them is auctioned in exchange for KITE. The KITE proceeds from the auction are then sent to the staking pool. As for buyback and burn, HAI is first accrued in the protocol's balance sheet. Once there's enough HAI in the balance sheet, the protocol can start to auction some of it in exchange for KITE which is then burned.

To visualize all this, you can check the diagram below:

NOTE: HAI only flows to the stability fee treasury, to stakers and in the protocol's balance sheet when the borrow rate charged to Safes is positive. When the borrow rate is negative, the protocol only uses funds from the balance sheet to repay HAI debt from all Safes.

3. KITE and the Money God League

KITE is also at the core of the Money God League as seen here and here. The Money God League is presented on this page.